Jessica wakes up with severe abdominal pain and visits her doctor, who orders an ultrasound. Her clinic submits a prior authorization request to her insurance company, but delays in approval push her test back several days. When she’s finally diagnosed with gallstones, a clerical error causes her surgery claim to be denied, delaying treatment further.

Finally, Jessica has her surgery and begins recovery. Meanwhile, the hospital’s billing department continues working through the claims process. Since much of the review is done manually, verifying every line item against her policy, the reimbursement is delayed. Weeks later, Jessica receives a bill for services her payer has yet to process. Confused and frustrated, she spends hours on the phone with both the hospital and her insurance company, trying to resolve the issue.

Now imagine a different scenario—one powered by generative AI. From the moment Jessica’s provider orders the ultrasound, an AI-driven system validates her insurance details in real time, flagging potential issues before submission. Prior authorization is approved instantly, allowing her to get tested the same day. When the hospital submits her claim, AI-powered automation reviews it, corrects minor errors, and processes payment in minutes instead of weeks. Jessica receives her care without delay, her provider gets paid on time, and the entire experience is seamless.

This is the future of health insurance claims processing—faster, more accurate, and most importantly, patient-focused.

The challenge: why claims processing slows down patient care

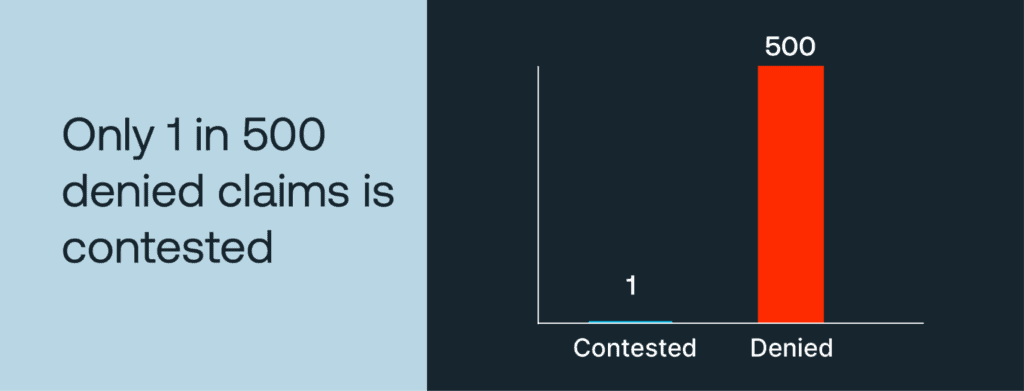

Claims processing is a complex, often manual process that can have a profound impact on patient care. Delays in processing can postpone critical treatments, leading to worsened health outcomes. In addition, patients may face unexpected out-of-pocket expenses due to billing inaccuracies, which can cause mistrust and frustration. Appeals are rare—only 1 in 500 denied claims is contested—leading many to forego necessary medical treatments or face financial strain. In the past two years, nearly 75% of healthcare providers have reported an increase in claim denials, often due to incomplete or incorrect data.

Currently, manual processing still accounts for 40–50% of claims. This entails the staff having to sift through multi-line submissions, navigate distinct business rules, and verify missing data, all of which slow down processing times. Legacy systems further complicate the issue, as many are unable to adapt to the increasing volume and complexity of claims. In addition, each denied claim costs providers $47.77 on average in administrative and appeals expenses, adding up to significant financial losses. As a result, providers lose an estimated $262 billion annually due to revenue cycle inefficiencies.

These challenges highlight not just operational inefficiencies but real consequences for patient care—delayed treatments, financial hardships, and eroded trust in the healthcare system. Traditional methods have proven insufficient in addressing the growing complexity and volume of claims, leaving both providers and patients vulnerable to these systemic issues.

The solution: how AI betters claims processing and patient care

With patient care at the forefront of healthcare priorities, payers are increasingly turning to automation and generative AI to address claims processing challenges in ways that directly impact patient well-being. Beyond streamlining operations, advancements in AI are transforming how claims are managed, ultimately ensuring that patients receive the timely, affordable care they need.

By reducing errors and accelerating claims processing, AI helps eliminate delays that can postpone critical treatments. Faster, more accurate claims approval means patients are less likely to face disruptions in their care plans due to administrative holdups. Additionally, AI-driven data accuracy reduces the risk of billing mistakes, protecting patients from unexpected out-of-pocket expenses that can cause financial stress and deter them from seeking necessary treatments.

Neudesic’s Document Intelligence Platform exemplifies how AI can improve patient outcomes through smarter claims management. By leveraging AI-driven data extraction, the platform efficiently classifies and validates unstructured submissions, reducing administrative bottlenecks that often delay care. Claims that previously required extensive manual review—such as complex, multi-line submissions—are now processed more swiftly, ensuring patients receive approvals and reimbursements without unnecessary waiting periods.

Generative AI also proactively identifies and resolves errors in real time, flagging missing information or discrepancies before they result in claim denials. This reduces the likelihood of patients facing coverage issues that could interrupt their access to medical services. Moreover, AI’s ability to manage business-specific rules at scale ensures claims are handled accurately from the start, minimizing the emotional and financial burden on patients caused by repeated appeals or corrections.

Perhaps the most impactful benefit of generative AI is its ability to speed up claims processing dramatically. Claims that once took days—or even weeks—to review can now be processed in minutes. This accelerated timeline means faster reimbursements for providers, quicker approvals for patients, and, most importantly, fewer delays in accessing the care patients depend on.

By reducing administrative barriers, minimizing errors, and accelerating processing times, AI is not just improving operational efficiency—it’s actively enhancing patient care, reducing stress, and fostering better health outcomes across the board.

Advancing in automation and STP

With patient care at the forefront of healthcare priorities and the advancement of AI, payers are increasingly turning to automation and straight-through processing (STP) solutions to solve for processing complexities.

Straight-through processing is an automated system that processes financial transactions electronically to improve operational efficiency, reduce errors, and prevent fraud.

However, widespread adoption remains a work in progress. Currently, only 30–40% of claims qualify for full STP workflows, but fortunately, advancements in AI-powered platforms are rapidly increasing this potential.

One area to improve automation and STP automation for claims processing is through data transparency. Payers and providers are working together to create more transparent claims cycles, helping to identify bottlenecks and expedite reimbursements. By improving visibility into the claims process, stakeholders can pinpoint inefficiencies and work toward faster, more accurate settlements.

Another area of improvement is the integration and continued advancements of AI-led claims management. Innovations in natural language processing and machine learning are enabling real-time claims validation, significantly reducing administrative delays. AI-driven models can quickly assess the accuracy of submitted claims, flagging inconsistencies and minimizing the need for manual intervention.

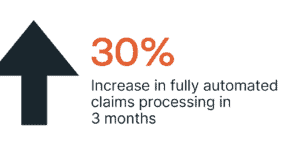

How AI streamlined 10,000 claims per month

Multi-line claims often present significant challenges, as they span various products, business lines, or providers, leading to processing delays that can directly impact patient care. Neudesic implemented a generative AI-driven model to streamline policy validations for a payer handling 10,000 claims per month. Within just three months, the payer increased fully automated claims processing by 30%, significantly reducing delays that could postpone patient treatments. This improvement not only saved over $2 million annually in administrative costs but, more importantly, ensured that patients experienced faster approvals, fewer coverage disruptions, and quicker access to the care they need. These results highlight the power of AI to improve healthcare outcomes while supporting operational efficiency.

Take action

The inefficiencies in health insurance claims processing—manual reviews, high denial rates, and outdated systems—are challenges the industry can no longer afford. Generative AI presents a path forward, enabling accelerated STP, higher accuracy, and improved patient care outcomes.

Neudesic’s Document Intelligence Platform is designed to help payers and healthcare providers transform their claims workflows. Ready to see the difference AI can make?

Discover how Neudesic’s AI solutions can reshape your claims process—contact us today or stay tuned for Part 2 of our series to explore further innovations in claims processing.

Related Posts