Let’s be real— insurance claims are often a source of frustration for both insurers and policyholders. The process can be slow, costly, and filled with inefficiencies. For insurers, every extra day a claim remains open adds to administrative expenses and operational strain. In an industry where policyholders expect fast, seamless service, slow claims resolution can lead to frustration and even loss of business.

AI-driven automation is changing this landscape. With advancements in Intelligent Document Processing (IDP) and generative AI, insurers can now automate everything from the First Notice of Loss (FNOL) to final payment, significantly reducing operational costs and improving customer satisfaction. Instead of weeks, claims can be resolved in days, improving efficiency while enhancing the customer experience.

In this blog, we explore how in today’s competitive property and casualty (P&C) market, achieving straight-through processing (STP) for complex auto claims is no longer just a goal—it’s a reality.

5 challenges in auto claims processing

Auto insurers face constant pressure to process claims quickly and accurately while keeping costs under control. Yet, many legacy processes still rely on manual data entry, fragmented communication, and outdated systems, leading to inefficiencies that slow settlements and frustrate customers. Addressing these challenges is critical—not just for improving efficiency, but for maintaining trust.

1. Long repair cycle times

On average, it takes 18 to 23 days to complete repairs for auto physical damage claims. This extended timeline not only delays settlements but also increases costs associated with rental car reimbursements and temporary transportation for policyholders. These inefficiencies not only drive-up costs but also impact customer satisfaction.

2. Manual data entry has higher error rates

The traditional claims process is filled with manual steps—data entry, document reviews, adjuster assessments, and back-and-forth communication with repair shops. In fact, more than 60% of manually entered claims contains errors, leading to rework, processing delays, and, in some cases, incorrect payouts. These mistakes often force insurers to revisit and correct claim details, adding to administrative overhead and slowing down resolutions.

3. High frequency of supplements in repair estimates

Another challenge is the high frequency of supplements in repair estimates. Nearly 63% of vehicle repairs require at least one supplement, typically due to missing or incomplete documentation at the time of initial inspection. Each supplement means additional time spent coordinating with repair shops, adjusting estimates, and securing approvals, further prolonging claim resolution.

4. High claims denial rates

Errors and missing information don’t just cause delays—they can lead to outright denials. Between 5% and 15% of auto insurance claims are denied annually because of documentation issues or inaccurate reporting. These denied claims create frustration for customers and additional work for insurers handling appeals and disputes.

5. Dissatisfied customers result in distrust

Beyond the direct costs of manual processing—such as staff hours spent re-keying PDFs, making phone calls to body shops, and reviewing police reports—these inefficiencies have significant indirect consequences. Prolonged claims processing can erode customer trust, leading to policyholder churn. In fact, 83% of dissatisfied claimants say they plan to switch providers. Given that P&C insurers allocate up to 80% of premium income toward claims payouts and handling, eliminating inefficiencies is not just about cost savings—it’s essential for maintaining profitability and retaining customers.

The solution: straight-through processing with AI

For years, insurers have pursued the goal of “touchless” claims processing, but the challenge has always been unstructured data. Police reports, handwritten notes, accident photos, and repair shop estimates all contain critical information, yet traditional claims systems have struggled to process this data efficiently. Manual intervention was necessary at nearly every step, leading to errors, delays, and increased costs. Now, with advances in artificial intelligence (AI) and automation, fully or partially automated claims processing is within reach.

Intelligent document processing advances unstructured data

Intelligent Document Processing (IDP) is a game-changer for handling unstructured data. Advanced Optical Character Recognition (OCR) and Natural Language Processing (NLP) extract structured data from accident reports, damage photos, and repair shop estimates with remarkable accuracy. AI ensures that claims are complete before they enter the insurer’s core system, eliminating the need for manual rework and reducing processing delays. By automating data extraction and validation, insurers can process claims faster and more accurately while freeing adjusters to focus on more complex cases.

Generative AI improves operations

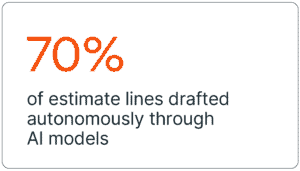

Generative AI further enhances automation by tackling traditionally labor-intensive tasks. AI models can analyze damage photos and generate up to 70% of estimate lines automatically, significantly reducing adjuster workloads. Automated systems can also draft denial letters, payment explanations, and other claim-related communications, cutting response times and improving operational efficiency. AI-powered chatbots enhance customer interactions by providing real-time updates and answering policyholder questions in a natural, conversational way.

Increased straight–through processing rates

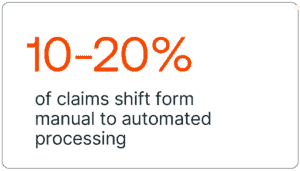

With these technologies in place, insurers can increase their straight-through processing rates significantly, shifting 10–20% or more of claims from manual handling to automated processing. The impact is substantial: lower costs, shorter settlement cycles, and fewer errors. As insurers embrace AI-driven claims automation, they can deliver a faster, more seamless experience to customers while achieving notable cost savings and operational efficiency.

ROI scenarios: increased straight-through processing rates

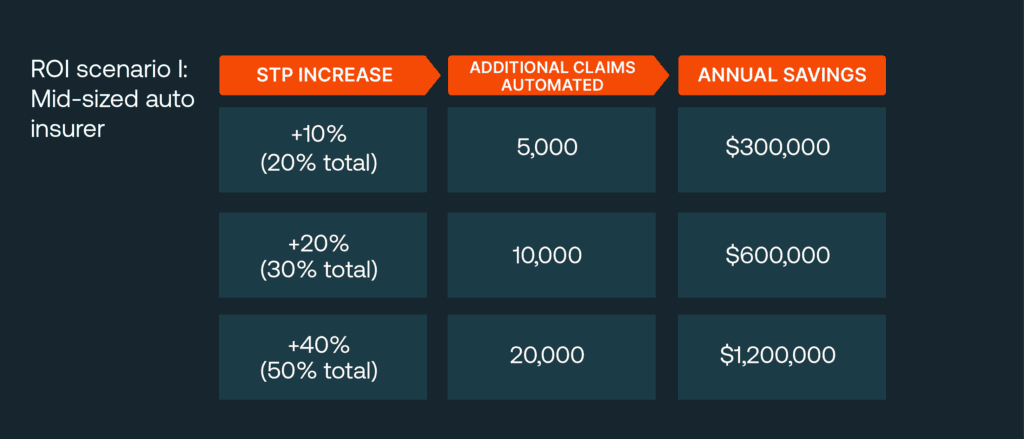

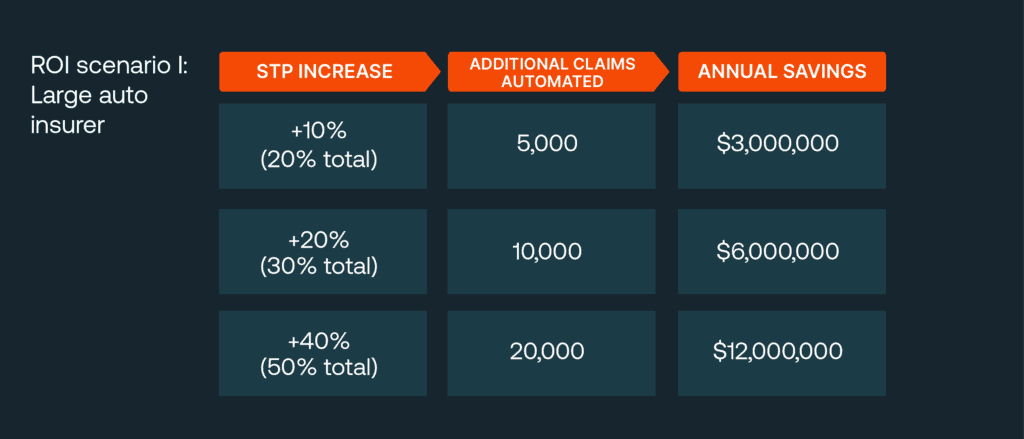

Increasing STP rates delivers measurable cost savings. Below are two ROI scenarios highlighting how increased STP directly translates into cost savings. These scenarios assume:

- Current straight-through processing rate: 10% of claims are touchless (i.e. simple glass-only or very low-severity collisions).

- Manual processing cost: $75 per claim (i.e. adjuster labor, overhead, rework).

- Automated (STP) cost: $15 per claim (IDP/AI platform and minimal human oversight).

- Cost difference: $60 saved for every claim shifted from manual to straight-through processing

- Implementation costs: Vary by carrier size.

ROI scenario I: Mid-sized auto insurer

- Annual claims: 50,000

- Current STP rate: 10% (5,000 claims)

The result: With a one-time implementation cost of $300,000–$600,000 and annual platform costs of $100,000, the payback period is under two years once STP rises beyond 20%.

ROI scenario I: Large auto insurer

- Annual claims: 500,000

- Current STP rate: 10% (50,000 claims)

The result: Even with a one-time $1–2 million implementation cost and annual expenses of $500K–$1 million, insurers recover costs within months, with savings exceeding $6 million annually at +20% STP.

5 benefits from automation beyond costs

While reducing costs and accelerating claims processing are clear advantages of AI-driven automation, the value extends far beyond the financial bottom line. Automation fundamentally improves the way insurers operate, which is just as critical to long-term success as cost efficiency.

1. Reduced cycle times

Shorter repair and settlement windows mean customers get their vehicles back faster, reducing frustration and the need for temporary transportation expenses. A streamlined claims process also improves relationships with repair shops and service providers, enabling a more efficient network that benefits both insurers and policyholders.

2. Increased accuracy

Automation also significantly enhances accuracy by minimizing manual data entry errors. When fewer claims require rework or adjustments due to mistakes, insurers save time, reduce denials, and improve operational efficiency. This not only leads to faster claim resolutions but also ensures policyholders receive fair and accurate settlements, strengthening trust in the insurer.

3. Fraud mitigation

AI can analyze claims data in real time, identifying inconsistencies, duplicate claims, or suspicious patterns that may indicate fraud. By catching fraudulent activity early, insurers can prevent financial losses and maintain fair pricing for all customers.

4. Scalability

Scalability is particularly important in times of crisis. When natural disasters or large-scale accidents cause a surge in claims, AI-driven automation allows insurers to handle the increased volume without overwhelming adjusters. This ensures policyholders receive timely support when they need it most.

5. Heightened customer loyalty

Perhaps the most valuable benefit of automation is its impact on customer loyalty. In an industry where switching providers is easy, a seamless and hassle-free claims experience can be a key differentiator. In this way, insurers can strengthen long-term customer relationships.

Ultimately, AI-powered claims automation isn’t just about cutting costs—it’s about creating a faster, smarter, and more resilient claims operation that benefits both insurers and the customers they serve.

Powered by AI with Neudesic

At Neudesic, we help insurers of all sizes implement next-generation automation solutions. We’ve worked with a regional auto insurer, who aimed to reduce claim cycle times and increase straight-through processing rates. Within six months, they saw a 35% reduction in cycle times and a 25-percentage point increase in STP, leading to significant cost savings and higher Net Promoter Scores.

This transformation was possible by focusing on three key areas.

- Industry-focused accelerators: Our intelligent automation frameworks streamline document ingestion, AI-driven classification, and claims system, reducing implementation time.

- Compliance and governance: Our solutions meet strict financial regulations, ensuring data security and compliance with state-specific insurance mandates.

- Comprehensive change management: We assist with process re-engineering, upskilling, and adoption strategies to maximize ROI.

Position your claims operation for the future

Advanced IDP and generative AI solutions now enable insurers to automate even complex auto damage claims, allowing adjusters to focus on high-value cases.

At Neudesic, we offer the tools, expertise, and frameworks to drive rapid straight-through processing gains with measurable ROI. By integrating AI into your claims infrastructure, you can unlock millions in savings and enhance policyholder experiences.

Ready to transform your claims operation? Contact us today for a customized assessment and see how our intelligent automation solutions can transform your auto insurance operations.

Related Posts