The Know Your Customer (KYC) process is a cornerstone of banking operations, but its complexities often create roadblocks. Lengthy and cumbersome procedures lead to customer frustration and increased dropout rates. These issues not only impact the customer experience but also slow down revenue generation. Neudesic addresses these challenges with its Document Intelligence Platform, an advanced intelligent document processing solution powered by Azure OpenAI. This platform automates data capture, cross-referencing, and real-time validation, significantly improving the onboarding process and streamlining compliance with customer identification programs.

Challenges Today from Know Your Customer (KYC)

In today’s fast-paced banking environment, customers expect quick, hassle-free service. Unfortunately, the Know Your Customer (KYC) process often slows things down. Manual and inefficient customer verification creates bottlenecks, which frustrates customers, leading to increased dropout rates, delayed account openings or loan approvals, and ultimately, delayed revenue generation. In fact, in the 2024 Global Research Report conducted by Fenergo, 45% of survey responders experienced client abandonment because of an inefficient onboarding process, 86% due to poor data management and siloed processes, and 77% because of a poor customer experience.

Automating Know Your Customer and Streamlining Workflows with AI

To address these challenges, automating verification and simplifying workflows allows banks to focus more on the quality of customer engagements rather than navigating cumbersome administrative tasks. In fact, the banking industry is undergoing a major transformation, with 46% of companies adopting generative AI for customer-focused applications. This shift underscores the increasing need for streamlined and intelligent document processing solutions to stay competitive.

By embracing AI, banks can align with current technological advancements, enhancing the customer experience with quicker, seamless services. This positions banks as innovation leaders while enabling market expansion by serving new customer segments with advanced capabilities. AI-driven tools also provide deeper insights into customer behaviors, supporting data-driven decision-making. Furthermore, leveraging AI reduces time-to-market for new services, accelerating revenue growth and facilitating faster asset accumulation. By offering a secure and efficient verification process, banks build trust and establish themselves as forward-thinking leaders in a crowded market.

Enhancing Customer Experience Through AI

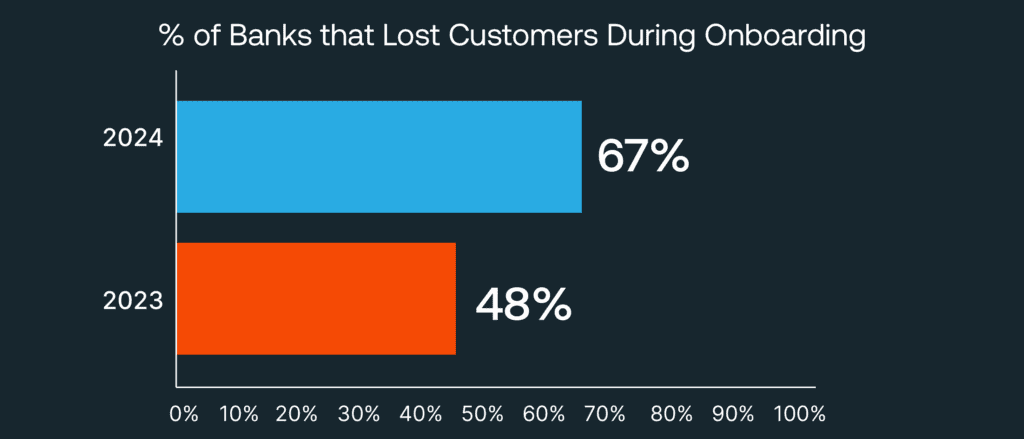

By streamlining KYC processes, banks can prioritize the quality of customer engagement over administrative challenges, fostering a customer-centric approach. Fenergo reported that 67% of banks lost a client as a result of an inefficient onboarding process. Efficient and secure onboarding processes build trust, enhancing confidence in a bank’s services. A hassle-free onboarding experience encourages loyalty and boosts retention rates. Internally, optimized processes improve resource allocation, supporting operational excellence. This efficiency accelerates time-to-market for new customers, driving deposits, loans, and other services that quickly increase assets under management. Additionally, a seamless and modern KYC process strengthens a bank’s reputation as a technologically advanced and customer-focused institution, setting it apart in a competitive market.

Intelligent Document Processing to Redefine Know Your Customer

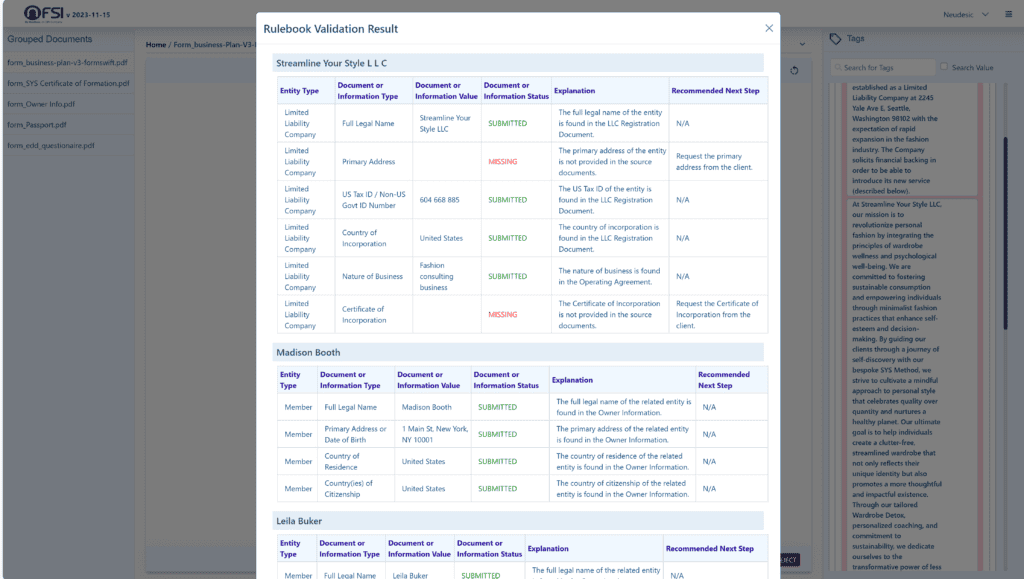

Neudesic’s Document Intelligence Platform automates the Know Your Customer process using an advanced intelligent document processing solution powered by Azure native services and Azure OpenAI. It automates the KYC process to enhance customer satisfaction through accelerated onboarding.

Traditional KYC processes can take days-or even weeks. This innovation drastically reduces processing times by capturing customer data from various formats, cross-referencing it with databases, and validating the information in real-time. Faster verifications allow customers to access banking services sooner, driving revenue growth through deposits and lending while minimizing abandonment during the onboarding process. By automating manual tasks, the platform improves operational efficiency, enabling staff to focus on strategic initiatives. It also ensures compliance with KYC regulations through accurate data handling, offering a seamless onboarding experience that gives banks a competitive advantage. Additionally, it integrates seamlessly with existing systems like Fenergo, creating a cohesive workflow that speeds up verification and onboarding.

Business Outcomes from Neudesic’s Intelligent Document Processing Solution

Implementing an automated KYC solution delivers significant business benefits by enhancing both efficiency and security. Improved data accuracy minimizes errors associated with manual entry, ensuring reliable customer information. Real-time verification accelerates decision-making, enabling swift account openings and loan approvals. Faster processing also supports quicker asset acquisition, allowing banks to manage customer assets sooner and realize immediate revenue gains. The solution’s scalability handles large volumes of KYC checks without increasing staffing costs, while automation reduces operational expenses by eliminating repetitive tasks. Advanced AI algorithms further enhance security by strengthening fraud detection, safeguarding both the bank and its customers.

Seamless Integration with Fenergo and Other KYC Solutions

Neudesic’s platform seamlessly integrates with established KYC solutions like Fenergo, enhancing their capabilities with intelligent document processing for a more robust and efficient workflow. This integration unifies multiple systems into a cohesive process, reducing IT complexity and minimizing the need for extensive maintenance or training. By combining the strengths of various tools, it creates a more effective verification system while improving collaboration between different solution providers. Faster implementation of updated KYC procedures streamlines onboarding, enabling quicker access to customer assets and accelerating revenue growth. This synergy delivers immediate impact, optimizing both operational efficiency and customer satisfaction.

Conclusion: Revolutionize KYC using Intelligent Document Processing

Neudesic’s Document Intelligence Platform revolutionizes KYC by automating tedious tasks, ensuring compliance, and delivering a superior customer experience. By integrating seamlessly with existing systems and leveraging Azure OpenAI, the platform helps banks onboard customers faster, reduce operational costs, and boost revenue growth. Transform KYC from a bottleneck into a business advantage. The future of banking is here-efficient, customer-focused, and AI-powered.

To learn more about how Neudesic brings positive impacts to financial organizations using data and AI technologies , visit https://www.neudesic.com/industries/financial-services/

Related Posts

Leave a Reply